What we have here is not just a wave but a tsunami of artificial intelligence. Maybe that is the reason why many are rushing to call it an AI bubble. Even that accusation can’t undermine the real advancements made in the field of AI.

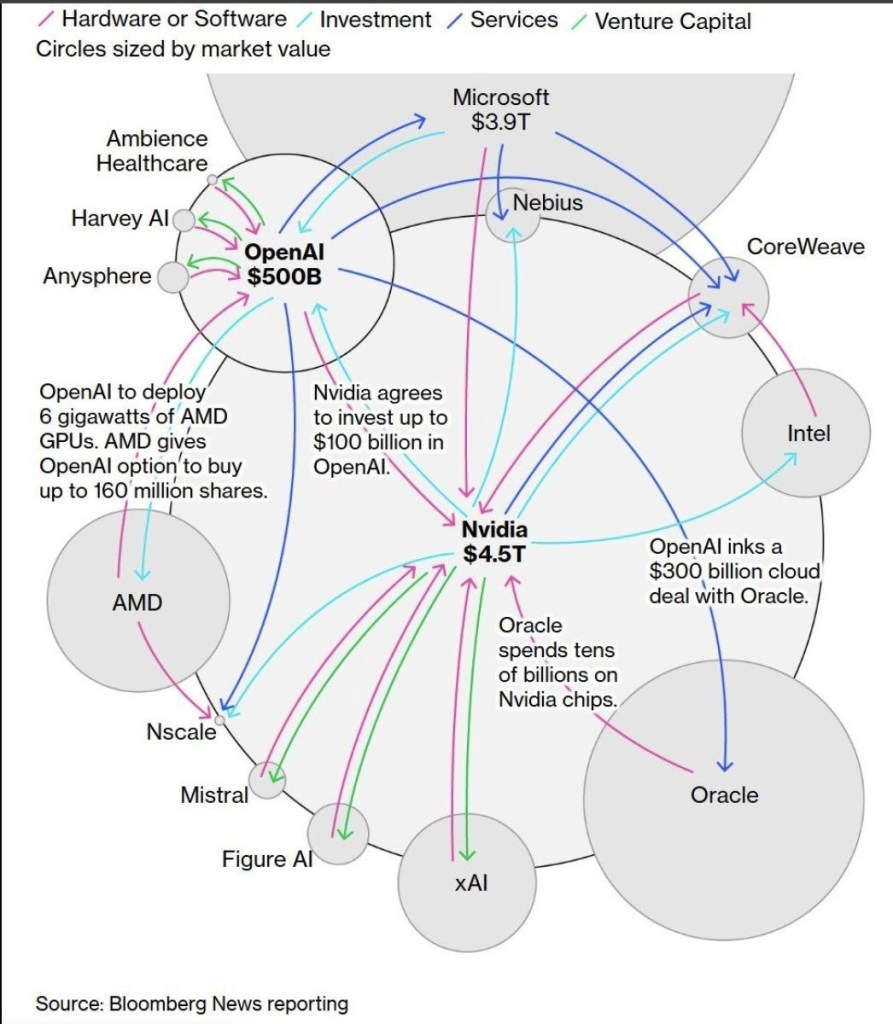

However, there is an image quickly going viral, illustrating a highly interdependent and circular investment ecosystem among tech giants like OpenAI, Microsoft, Nvidia, Oracle and AMD. This intricate web has given people another reason to dub the current excitement as an AI bubble.

In this blog, we are going to explore the relationships shown in the image, how it contributes to the AI bubble narrative, the overall impact of this investment frenzy and possible future scenarios.

The Anatomy of AI Interdependence: A Circular Economy

To explain it simply, the image shows a circular flow of capital and commitment between the companies that build the AI models and the companies that supply the underlying infrastructure. Allow me to introduce the key players of this game.

OpenAI: Your AI Model Builder and a Compute Consumer

OpenAI is the creator of massively successful models like GPT and DALL-E. But to train these models and run their services, OpenAI needs computing power of unprecedented scale. This demand makes it one of the single most important customers in the world. As per the estimations, it costs around $100 million to train GPT-4.

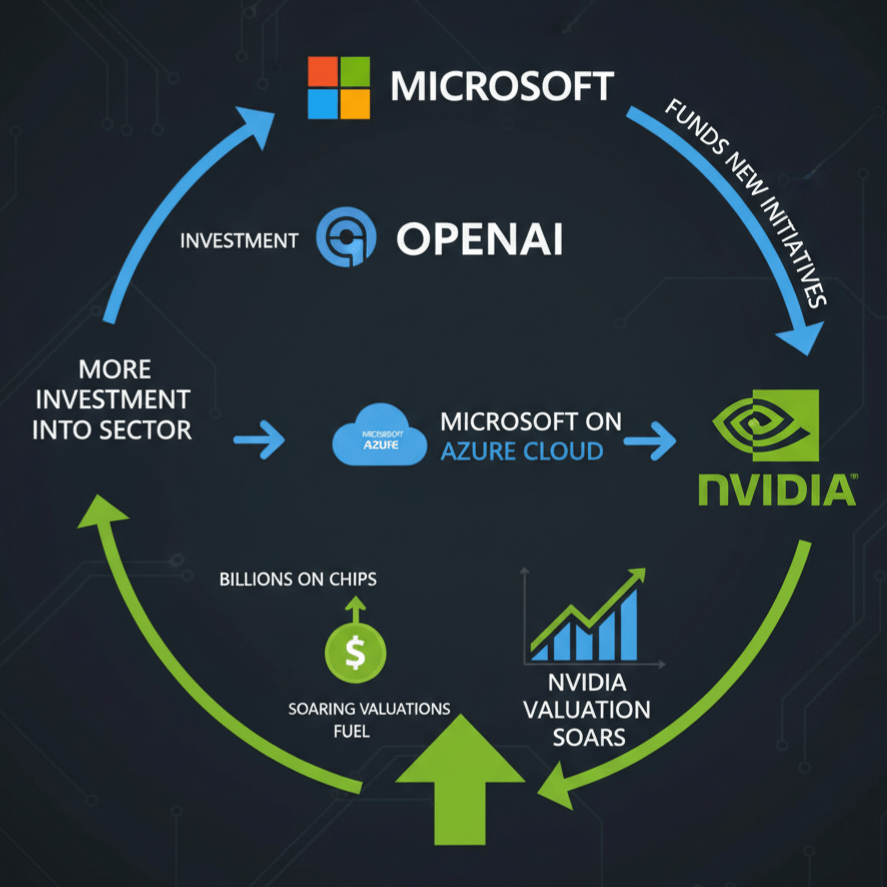

Microsoft: Investor and Cloud Partner

Microsoft is OpenAI’s largest investor and strategic partner, hosting its primary infrastructure on Azure. Initially, the technology giant invested $1 billion in OpenAI in 2019, followed by a multi-year, multi-billion-dollar investment to secure an exclusive partnership.

In return, Microsoft provides OpenAI with the massive compute capacity on Azure, effectively channeling the investment money back to its own cloud services division. Microsoft may receive a large share of profits until its investment is recouped.

Nvidia & AMD: Chip/Hardware Suppliers

These companies design and manufacture the highly specialized Graphics Processing Units that are capable of efficiently handling large-scale AI workloads. Nvidia’s H100 Tensor Core GPU, costing between $25,000 and $30,000 per unit for direct purchase, has become the world’s most sought-after commodity in this AI rush.

Nvidia controls over 90% of the global chip market. Cloud providers are its largest customers who spend billions of dollars to secure these chips, which are then sold or leased to AI companies like OpenAI, contributing to Nvidia’s circular revenue.

One can say that GPUs are to AI companies what routers and networking equipment were to dot com companies and picks and shovels were to gold mining companies.

Oracle: Computing Capacity Provider

Oracle is another tech giant that has not only survived the dot com crash but thrived in its aftermath. Nowadays, it competes with the likes of AWS and Azure by signing multi-million dollar deals to provide cloud capacity to AI companies. Oracle uses a simple strategy to meet the surging demand by extending Microsoft Azure’s platform onto the Oracle Cloud Infrastructure.

The Interdependence Loop: Money Chasing Chips

Now, after understanding the key players of this game and their roles. We move ahead to unravel the relationships or as the image shows, interwoven investments, between them that lead to the creation of a self-reinforcing financial loop.

- OpenAI Commits Massive Spending: OpenAI signs trillion-dollar commitments throughout many years with cloud providers like Oracle, and Microsoft Azure and chip suppliers such as Nvidia and AMD to secure the enormous compute power it needs.

- Suppliers Invest in OpenAI: The suppliers, such as Nvidia, have invested up to $100 billion in OpenAI, and AMD has also offered equity to take financial stakes in OpenAI.

- Money Flows Back to Hardware: OpenAI uses the huge investments it receives from its financiers or partners to buy the chips and cloud services from those very same companies.

- Revenue Drives Valuation: This circular flow immediately boosts the revenue of the chip makers, i.e., Nvidia and AMD, and cloud providers, i.e., Microsoft and Oracle, which in turn validates their soaring market valuations.

The Interdependence Flow and its Outcome

Money leaves the balance sheets of the suppliers in the form of investment and quickly re-enters as revenue through customer (which are the same companies they have invested in) purchases, fueling more investment and greater valuation in this trillion-dollar loop.

The AI Bubble Narrative: Speculation vs. Fundamentals

The AI Bubble concerns arise because this circular investment dynamic has inflated valuations that appear to be disconnected from proven, end-customer profitability.

Inflated Valuations

Current earnings alone don’t determine the valuation of companies like Nvidia and OpenAI. It also considers factors like market capitalization, future expectations and transformative growth. Nvidia, as the near-monopoly chip supplier, is often cited as the biggest beneficiary and potential fault line. The valuation of Nvidia reaches a new historic high of $5trillion mark by consolidating power in the AI boom.

You can also see: Nvidia nears $5 trillion valuation on AI, supercomputer deal | REUTERS

CapEx Explosion

To secure AI infrastructure, tech giants are committing unprecedented amounts of Capital Expenditure or CapEx. They used to be asset-light software companies, committing Operating Expenses or OpEx. but now, they are gradually turning into asset-heavy infrastructure companies.

Microsoft, Google, Meta and Amazon, all are planning to spend billions of dollars every year to procure AI chips and data centers. If their AI models can’t materialize returns as quickly as expected, then their massive investments will be at even greater risk.

Synthetic Demand

These kinds of interrelated investments and deals create a synthetic demand where purchases are financed by the same group of players, rather than an actual and profitable requirement from a broad base of end users.

The tech giants invest in AI companies because AI apps are used widely across the world nowadays, resulting in speculations about revolutionizing the targeted sectors and high profit projections. However, the wide use of AI models today is not a proof of profitability tomorrow.

Impact and Possible Scenarios: From the Lens of Game Theory

When it comes to analysis, I love to use game theory; not any mathematical calculations but a simple exercise of exploring various probabilities.

| Positive Impact: “AI is real” Scenarios | Accelerated Technological Advancement | Creation of Essential Infrastructure | Productivity Revolution |

| The sheer volume of AI investment leads to breakthroughs happening at an unprecedented speed. | Even if the valuations take a hit, the infrastructure will still exist that can act as a foundation for the next few decades of computing and enterprise app development. Similar to how fiber optic cables survived the dot com crash. | AI is already driving significant gains in productivity in almost every sector it is implemented in, ranging from code generation to drug discovery. | |

| Negative Impact: “Bubble burst” scenarios | Market Correction and Economic Contraction | Vaporware and Wasted Capital | Consolidation of Power |

| A sharp correction might be seen in the stock value of AI companies. The same tech giants that are heavily invested in AI also command a huge percentage of major indices such as S&P 500. So, an AI crash can potentially trigger a market collapse. | Most of the investment capital might get burned on highly ambitious projects that yield next to no returns or very miniscule profit. This may hinder the path to innovation. | With the amount of money invested in the market, tech giants can dictate the terms and direction of the AI advancements. Small AI companies and startups may find it difficult to keep pace with the infrastructure demands, limiting innovation and healthy competition. |

Summary

This whole debate around the AI bubble is not really discerning whether this technology has any future. There is no doubt about AI’s long term potential; it is already widely accepted as a transformative technology. The real questions are about the timing and the price paid for its potential.

More importantly, will these solutions find a broad base of real end-users that could drive actual profits and growth instead of driving revenues in a circular loop? Because, without real end users, they are destined to fail, and if any single company fails, their interdependencies will trigger the domino effect.